After cutting costs for years, gold mining companies may have finally squeezed out the last possible drop of efficiency (and even a little luck). If gold’s price doesn’t go up soon, what’s to come of gold supply?

After viagra tightening expenses for years, could it be that gold mining companies have finally reached their cost-reduction limit? Recent analysis from Lawrence Williams presents several compelling pieces of evidence to support this possibility.

Writing on Seeking Alpha, Williams examines the true nature of the major mining companies’ cost cuts – in particular, where they stem from. Several times, Williams reminds us that the long-term effects of these cost-cutting methods are negative. For example, online Abilify a recent decline in exploration for new sources and an overall reduction in capital projects do not bode well for future supply, and it’s precisely these two factors that have been a huge part for how companies have been able to cut expenses in recent years as the price of gold has leveled off from its highs.

Williams viagra side effects also notes that many factors that have allowed companies to reduce their costs are entirely external, and as such, outside of their direct control. Two such factors are the recent drop in oil gnc viagra prices and the appreciation of the dollar.

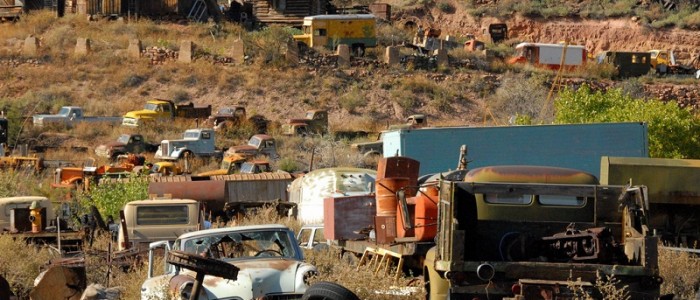

With oil prices well down from recent highs, mining vehicles and equipment that run on gas can be operated at lower costs than normal. This is especially true in the cases where mining operations aren’t able to receive power from a grid, but instead need to generate it themselves.

The rise in dollar’s value also had a positive short-term effect on mining operations for a simple reason: Miners are paid for their ore in gold, but bear much of their mining costs in local currencies. With most currencies recently weaker to the dollar, mining companies have been able to realize more profits than normal.

Unfortunately, both of these factors could turn on the mining companies as swiftly as they became a benefit. There’s no real telling cialis generic when oil prices will move back up, but they can’t stay this low indefinitely. And when they reach more normal viagra side effects constipation levels again, the mining industry will not only take quite a hit, but will need to find other ways of cutting costs – ways that will prove debilitating for gold supply. Similarly, once the dollar begins to weaken versus other currencies, mining operations will suddenly become a lot less profitable.

Williams also examined the world’s five largest mining companies, noting the transparent and unstable nature of many of their cost-cutting methods. Even more concerning is the point mentioned earlier: There doesn’t appear to be much more that these companies can do to cut expenses. In fact, it’s just the opposite; it would cialis seem that costs can only get higher from here.

Williams ends with a somber warning: “Should the dollar stutter, and oil prices recover, those beneficial extraneous factors which have distorted costs downwards in the latest quarters may become liabilities moving forwards. Indeed it may be surprising if these major miners can remain within their cost guidance for the year ahead.”

Should the mining industry cease to be profitable, it spells bad news for global gold supply. But with demand for the metal as strong as ever, something has to give.

Read reviews on Birch Gold Group here.

Photo Credit: ONE/MILLION via Compfight cc